101. Statement on the Federal Reserve

Greg Mankiw discusses the importance of the Federal Reserve's independence for economic performance and criticizes attempts to undermine it through political means.

your daily dose of economic commentary

Greg Mankiw discusses the importance of the Federal Reserve's independence for economic performance and criticizes attempts to undermine it through political means.

The post discusses the transformative potential of Claude Code for social scientists, highlighting risks and the unique challenges faced by users unfamiliar with its capabilities.

Pallavi Gogoi discusses the rise of single mothers in their 40s due to the accessibility of IVF technology.

A subpoena from the Justice Department targets the Federal Reserve regarding chair Jerome Powell's testimony, which he views as part of a pressure campaign on interest rates.

Scott Cunningham discusses the revolutionary impact of Claude Code, its creator Boris Cherny, and the gap in understanding its use among social scientists compared to programmers.

An examination of the economic outcomes of Trump's policies, contrasting his claims of success with public sentiment and objective economic indicators.

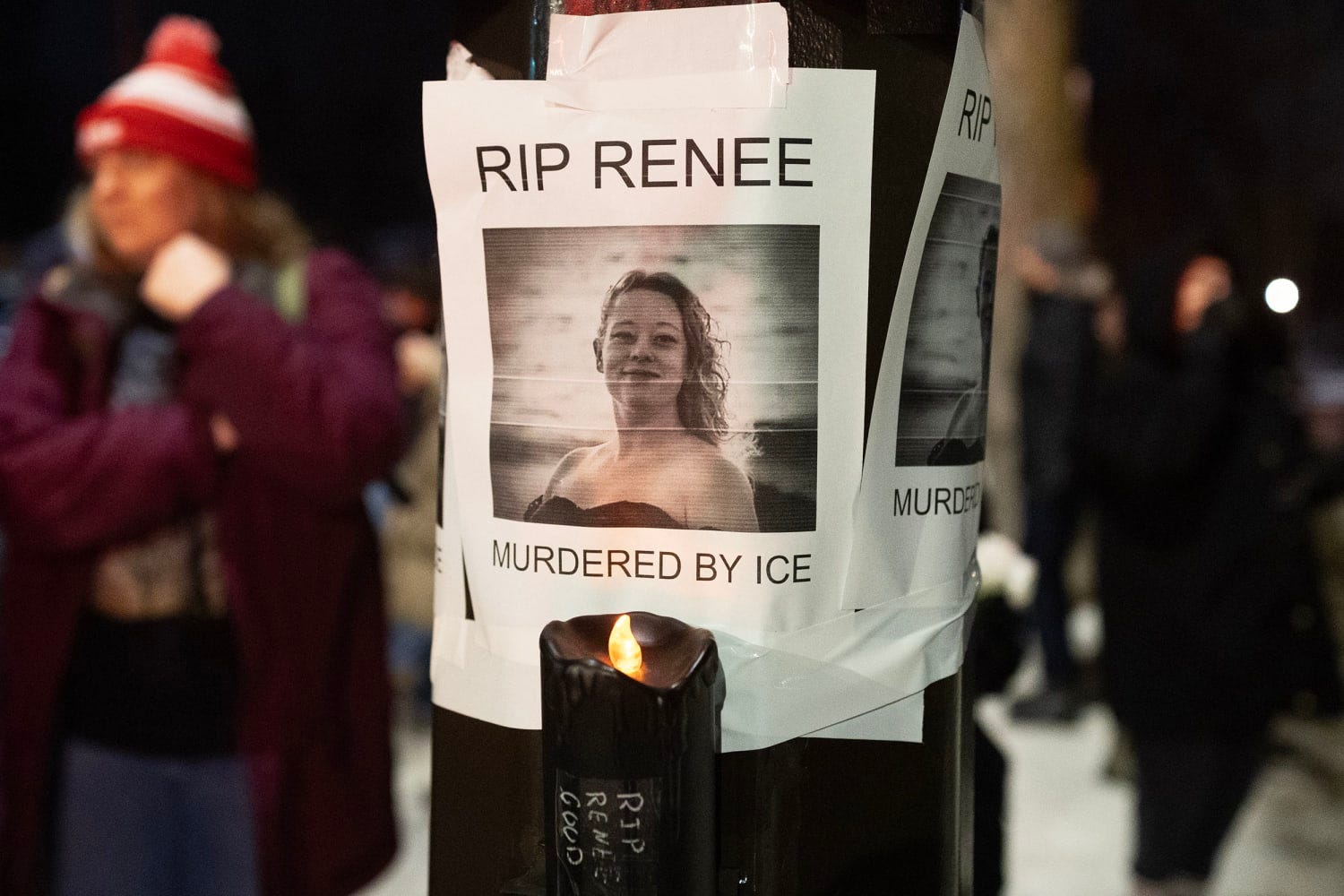

The post examines a controversial shooting incident involving an ICE agent and questions the justification for the use of lethal force against an unarmed individual.

Regan critiques the stigma against leftists, arguing that it is exaggerated and that socialism attracts individuals labeled as "losers," while highlighting cultural dominance of left-wing views.

The discussion focuses on the complexities of regime change in Venezuela, highlighting the U.S.'s inability to control outcomes despite removing Maduro, and the strengthening of the existing regime.

Bill McBride outlines key economic reports and data releases scheduled for the week of January 11, 2026, focusing on inflation, home sales, and manufacturing.

Eric Deggans discusses the increasing power of audiences in shaping the future of news and entertainment by 2026.

The discussion centers on fiscal dominance, its implications for monetary policy, and the need for credible fiscal adjustments to avoid inflation and instability.

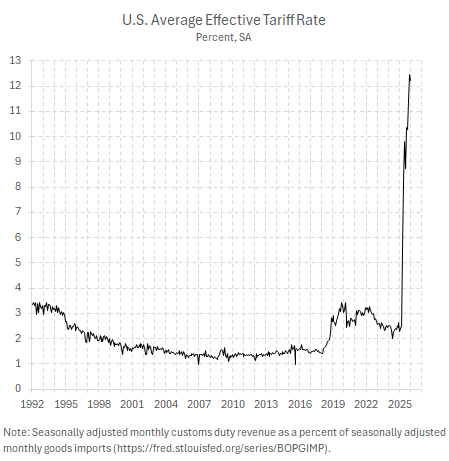

An argument that the effective tariff rate has recently surpassed 12%, indicating potential cost increases and delayed price effects due to stockpiling and past policy decisions.

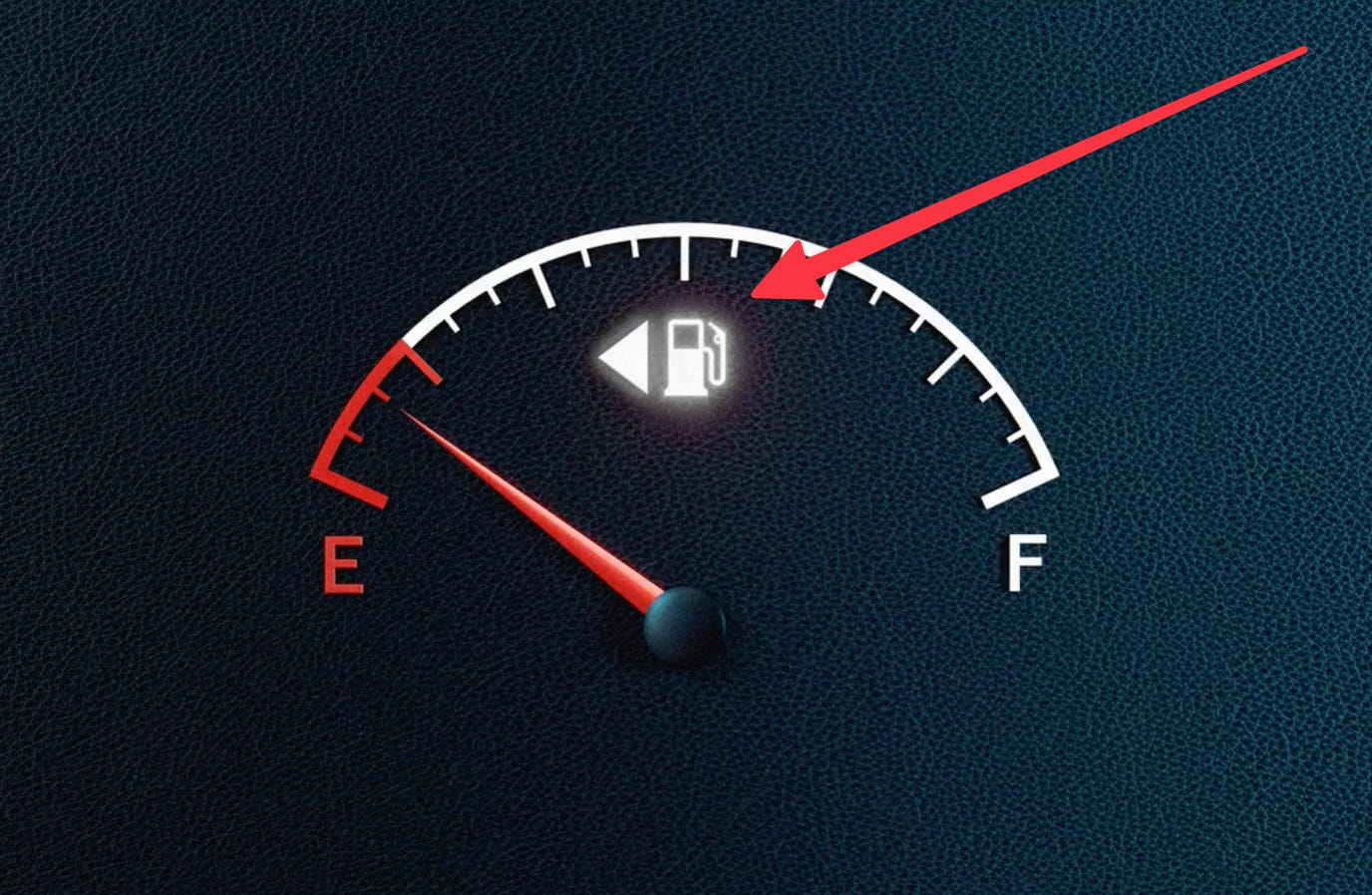

The post discusses the invention of a simple car feature that indicates fuel tank location, its impact, and parallels with AI's role in design innovation.

The post discusses the increase in household net worth, debt trends, and the value of real estate and equities in Q3 2025.

The post discusses Trump's political struggles, his manipulative tactics to maintain power, and the implications of his actions on public perception and policy.

An argument that America must enhance its manufacturing capabilities in electric technologies to remain competitive globally, particularly against China's advancements in the sector.

Bill McBride discusses the decline in housing starts and building permits in October, highlighting changes in single-family and multi-family units.

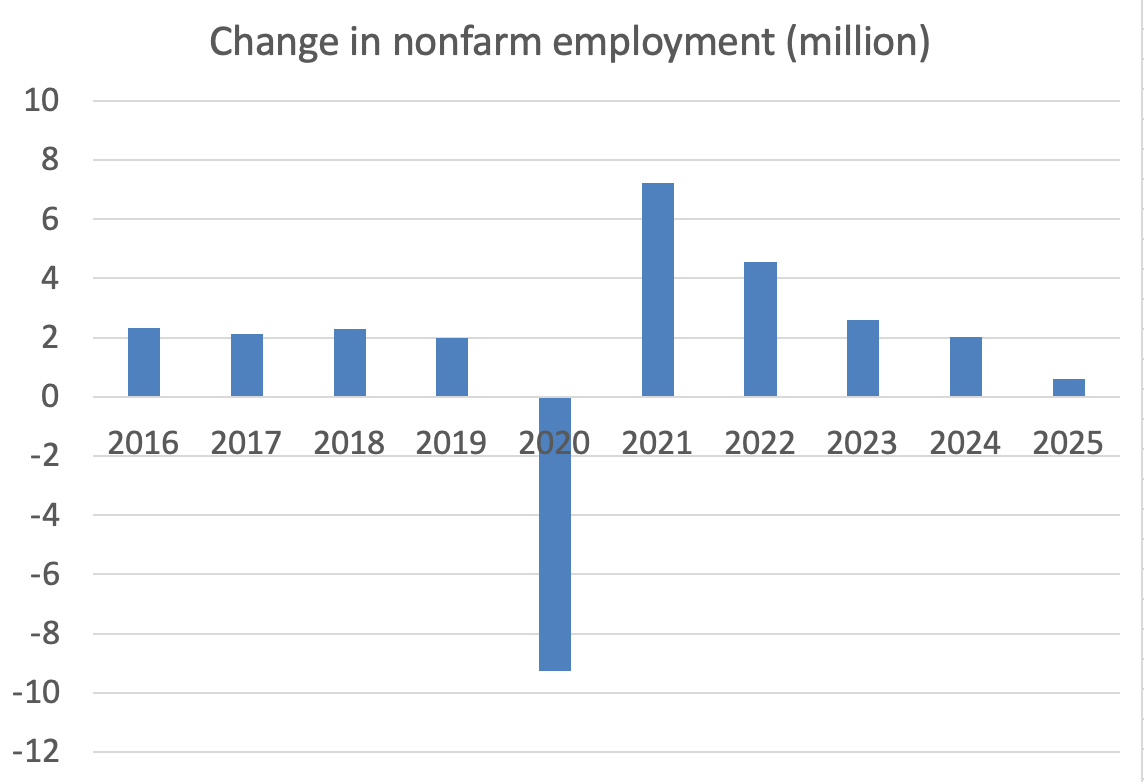

Bill McBride analyzes the December employment report, noting a slight miss in job numbers and a decrease in the unemployment rate to 4.4%.

Job growth in December was weak, marking the slowest annual increase since 2020, as reported by the Labor Department.