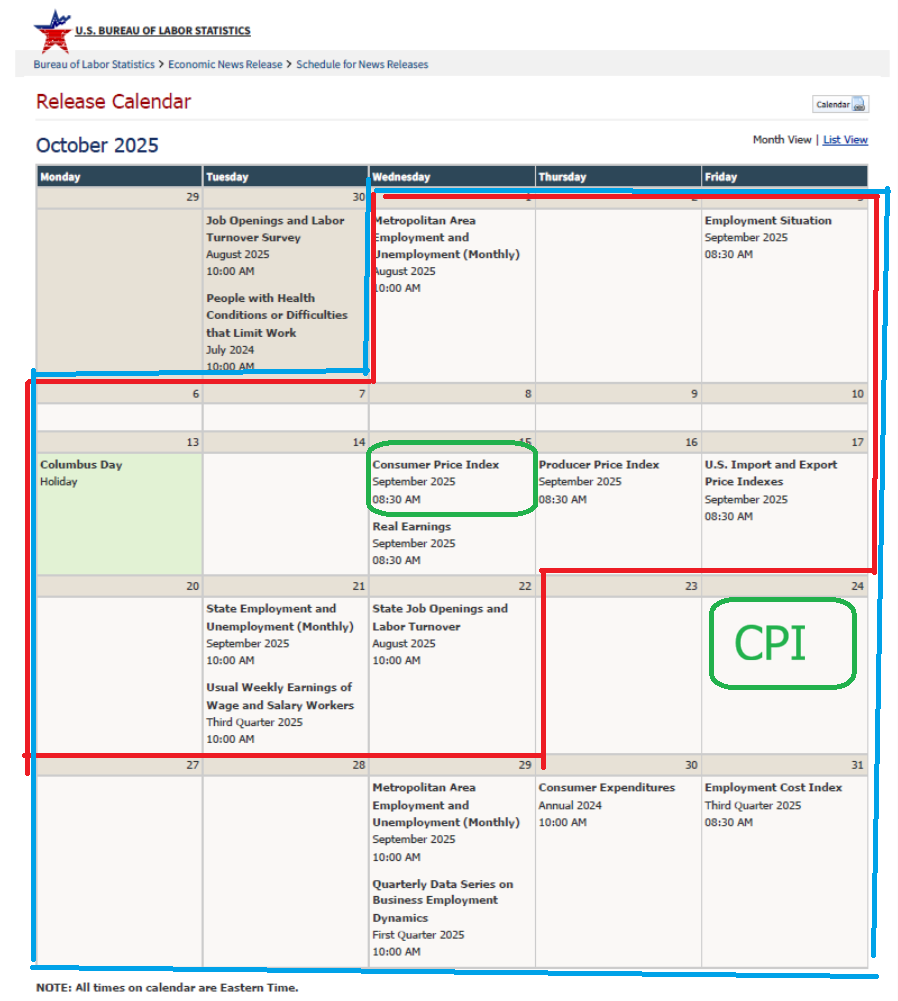

941. Schedule for Week of October 12, 2025

Bill McBride outlines key economic reports and data releases scheduled for the week of October 12, 2025, while noting potential delays due to a government shutdown.

your daily dose of economic commentary

Bill McBride outlines key economic reports and data releases scheduled for the week of October 12, 2025, while noting potential delays due to a government shutdown.

An argument that Trump may impose a 100% tariff on Chinese imports, raising concerns about economic repercussions and potential recession risks.

The post discusses the economic data releases that will be missed due to a government shutdown, highlighting specific reports from the BLS and BEA.

The discussion focuses on the evolution, challenges, and economic impacts of US biofuels, particularly regarding production methods, market effects, and environmental implications.

A drugmaker agrees to a deal with the Trump administration aimed at reducing U.S. drug prices as part of a broader initiative.

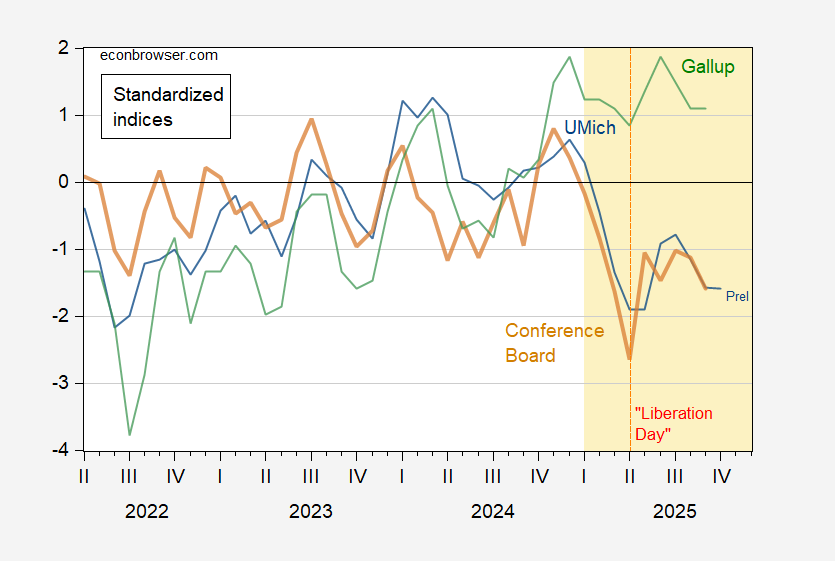

Menzie Chinn analyzes consumer sentiment data and its implications, particularly in light of economic conditions reminiscent of the global financial crisis.

Nate Silver analyzes the internal divisions within the Democratic Party, arguing that it is more complex than simply being dominated by progressives or centrists.

The post discusses the broken window fallacy, illustrating how destruction, like Godzilla's rampage, does not create economic growth but rather represents a significant loss.

An argument that tariffs have not caused the expected recession or inflation, highlighting the role of tax avoidance and the impact of AI investment on the economy.

Noah Smith discusses the challenges China faces in maintaining its global power, particularly focusing on demographics and the implications of U.S. political actions.

Scott Cunningham discusses his predictions for the Nobel Prize in economics, highlighting notable economists and their contributions to the field.

Federal employees express renewed hope for their voices to be heard following layoffs and funding cuts during the government shutdown.

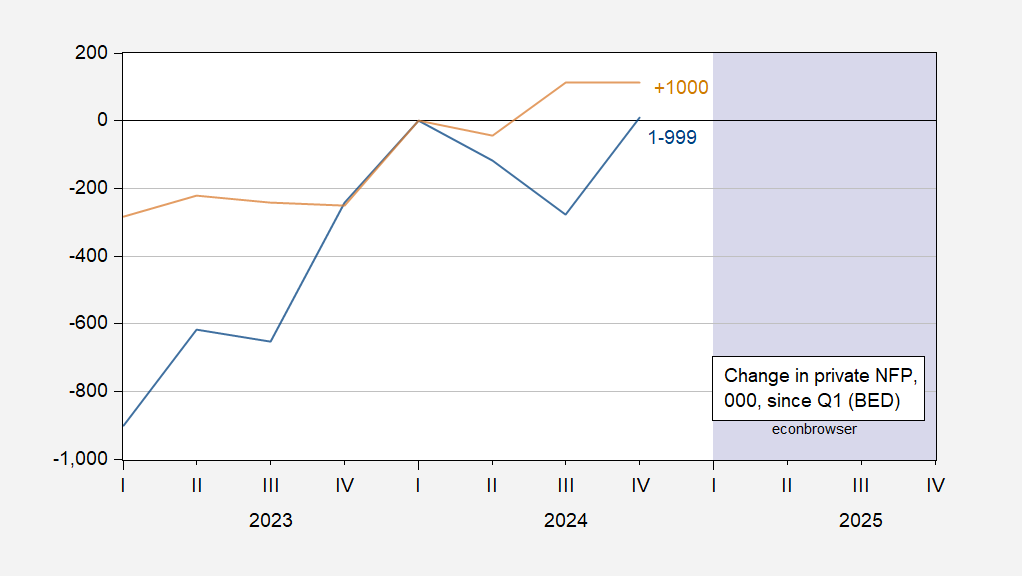

Menzie Chinn discusses employment growth disparities between small and large firms, highlighting a slowdown in smaller firms based on recent data.

An argument that the housing affordability crisis may be overstated, emphasizing the importance of considering inflation, income growth, and home size in price analyses.

An argument that Robin Hanson and Vitalik Buterin deserve a Nobel Prize for their contributions to prediction markets and applied mechanism design in economics.

Paul Krugman critiques the Trump administration's support for Argentina's government, highlighting the economic failures and political motivations behind the proposed financial aid.

The post reflects on the contributions of a notable female finance blogger, Tanta, and her insights into the mortgage industry during her time writing for the blog.

An argument that common misconceptions about credit card debt can hinder effective financial decision-making and understanding of personal finance.

John Ruwitch discusses China's export restrictions on rare earths to enhance its negotiating power in upcoming trade talks with the U.S.

A report reveals that renewable energy has surpassed coal in global electricity generation for the first time in history.