921. Data centers are booming. But there are big energy and environmental risks

The post discusses the rapid growth of data centers and the significant energy and environmental challenges they pose.

your daily dose of economic commentary

The post discusses the rapid growth of data centers and the significant energy and environmental challenges they pose.

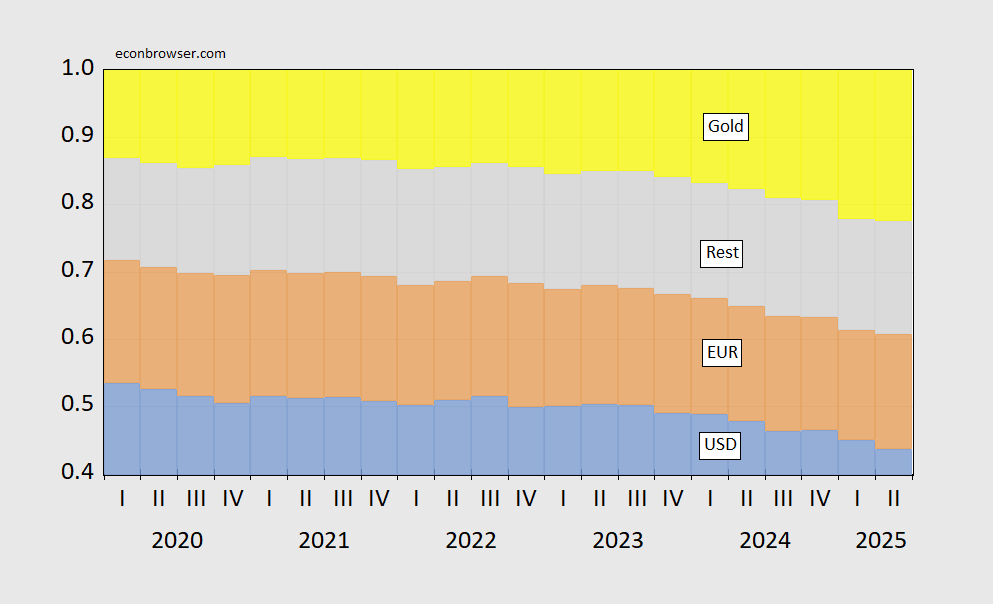

Menzie Chinn discusses the composition of central bank reserves, focusing on the increase in gold holdings driven by rising gold prices in Q2.

Timothy Taylor discusses the Nobel Prize awarded for explaining innovation-driven economic growth, highlighting the contributions of Aghion, Howitt, and Mokyr while noting gaps in their explanations.

Jon Murphy discusses the Nobel Prize in Economics awarded to Mokyr, Aghion, and Howitt for their contributions to understanding innovation-driven economic growth and its historical context.

The post examines the financial implications of buyout clauses for fired college football coaches, highlighting the economic rationale behind these lucrative payouts despite job instability.

An argument that Trump's trade policies are undermining U.S. economic strength and inadvertently benefiting China by disrupting established international trade norms and scientific research funding.

The post reflects on the contributions of a co-blogger to discussions about the mortgage industry, particularly focusing on foreclosure and loan servicing complexities.

An argument that Kimmel's return to late night television demonstrates its ongoing relevance and potential to engage American audiences effectively.

Scott Horsley discusses the Nobel Prize winners for their research on technological innovation and its impact on economic growth and creative destruction.

Three economists received the Nobel Prize for their research on the relationship between technological innovation, economic growth, and the concept of creative destruction.

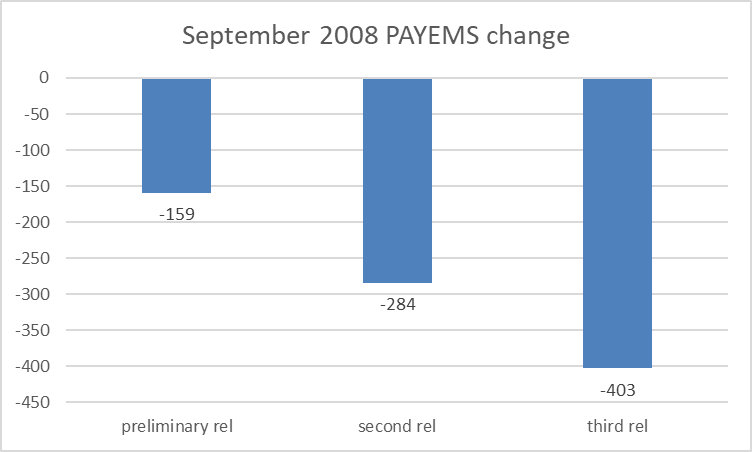

An argument that missed economic data releases can significantly impact understanding during critical economic turning points, highlighting the importance of timely and accurate information.

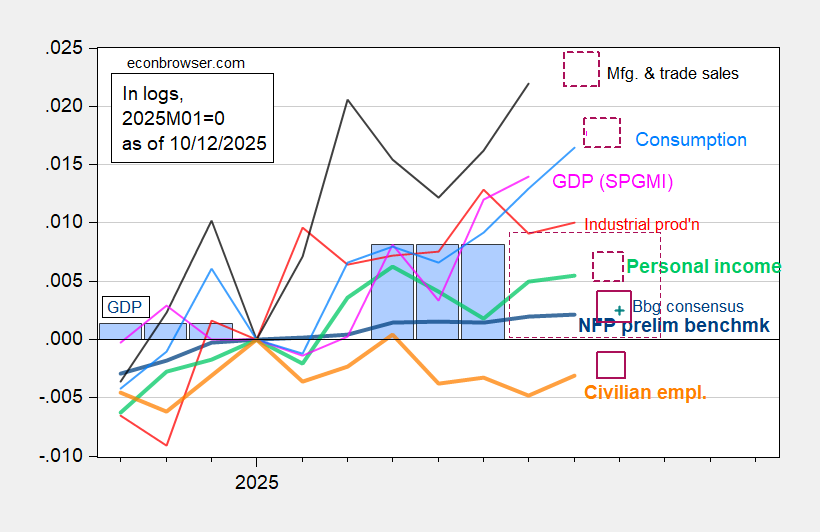

Menzie Chinn discusses key economic indicators affected by a potential government shutdown and their implications for employment and GDP data.

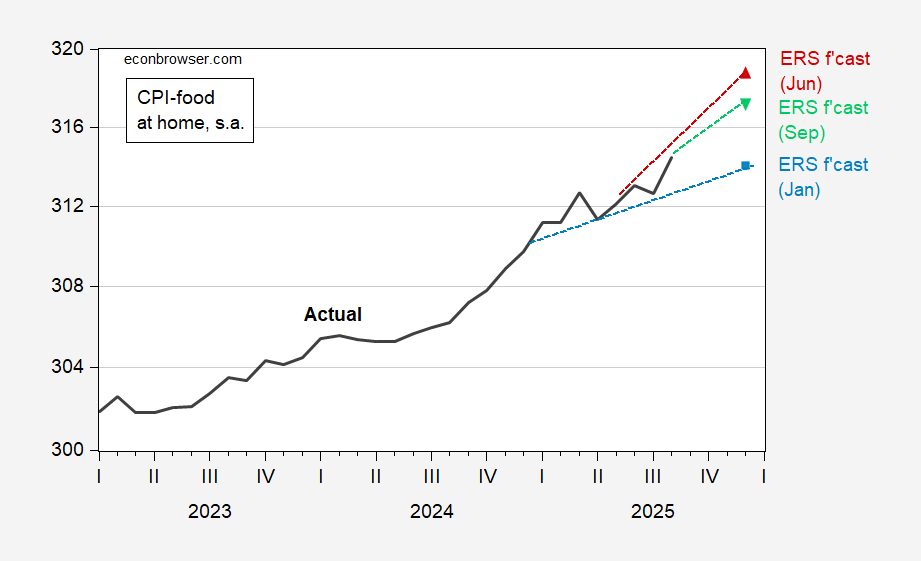

An argument that immigration policies are creating labor shortages in the agricultural sector, impacting food production and highlighting the reliance on unauthorized workers.

Paul Krugman discusses the potential AI bubble, its historical context, and the economic consequences of technology manias.

An argument that the U.S. economy's resilience may depend on the performance of the AI sector amidst challenges like tariffs and weak consumer sentiment.

Fans express outrage over FIFA's high ticket prices for the upcoming men's World Cup in the U.S., contrasting initial excitement with financial disappointment.

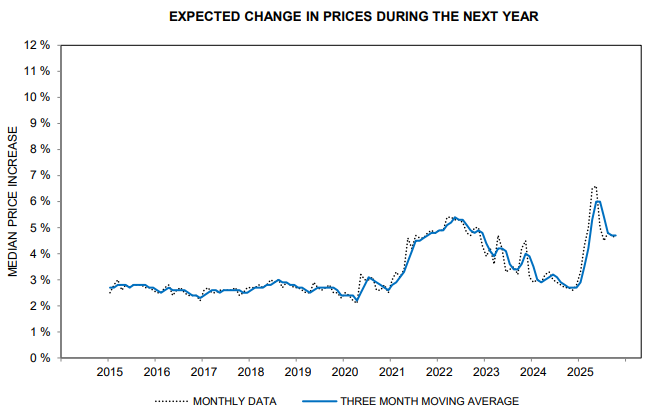

Menzie Chinn critiques EJ Antoni's claims about inflation expectation data, emphasizing the stability of political affiliations and their impact on economic sentiment analysis.

Jon Hartley interviews Arthur Laffer about his career, the Laffer Curve, and the impact of tax policy over the past 50 years.

A discussion on the implications of artificial intelligence, its current capabilities, and its potential impact on economies and society.

Robert Vienneau discusses the restrictions on wage negotiations in the U.S., emphasizing the role of laws and labor unions in shaping workers' rights and conditions.