841. Hotels: Occupancy Rate Decreased 2.4% Year-over-year

Bill McBride discusses the decline in hotel occupancy rates due to weak international tourism and uncertainty affecting the industry.

your daily dose of economic commentary

Bill McBride discusses the decline in hotel occupancy rates due to weak international tourism and uncertainty affecting the industry.

Max Molden discusses the importance of focusing on the economic system rather than specific industries for sustainable prosperity, using Germany's past economic success as a case study.

An argument that rural Americans' political choices contradict their economic interests, highlighting the disconnect between their dependence on government aid and support for Republican policies.

Existing-home sales rose 1.5% in September, with inventory increasing and median prices up, reflecting trends in the housing market.

Scott Neuman discusses the scarcity of starter homes and offers strategies for homebuyers to improve their chances of finding affordable options.

Rafael Nam discusses the rising costs of sports tickets and how they are excluding many dedicated fans from attending games.

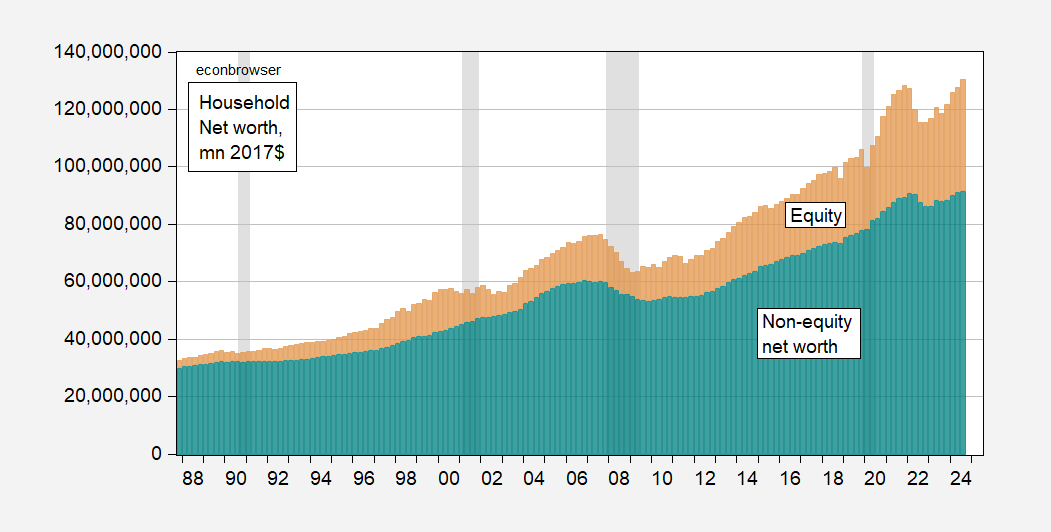

An analysis of potential impacts on US household wealth from an equity market correction similar to the 2001 dotcom bust, including consumption effects.

The discussion centers on the implications of government shutdowns for political dynamics, particularly how polling data influences perceptions of accountability among Democrats and Republicans.

The post discusses declining architecture firm conditions, indicated by a low Architecture Billings Index, suggesting ongoing softness in the sector and potential future impacts on commercial real estate investment.

The discussion highlights the inconsistencies in marijuana policy across states and the implications for public health and safety due to federal classification.

An argument that profits serve as a form of social authentication, reflecting consumer preferences and enabling market efficiency through individual choices and collective voices.

Paul Krugman discusses the disconnect between perceived economic stability and underlying issues, highlighting political uncertainty and inequality affecting the U.S. economy.

An argument that circular financial arrangements among AI companies may signal potential instability and inflation of perceived value, reminiscent of the dot-com bubble.

Mortgage applications fell slightly, while refinancing activity increased due to lower rates, indicating mixed trends in the housing market compared to previous years.

The post shares personal experiences and photos from a trip to Patagonia, highlighting its natural beauty and significant landmarks.

Timothy Taylor discusses Medicare fraud related to non-emergency ambulance transport for dialysis patients and the implications for government spending oversight.

Jadrian Wooten discusses various stories highlighting economic principles and teaching applications, including basic income, corporate banking, and market competition.

Builder confidence in the housing market increased in October, yet remains below the threshold indicating positive sales conditions, reflecting ongoing economic challenges.

Alex Tabarrok discusses the Baumol effect, emphasizing its implications on labor-intensive repair services and the shift towards cheaper new goods over time.

An argument that explores the concept of "fair price," distinguishing between price and cost, and questioning the morality associated with pricing in a world of scarcity.