821. FOMC Preview: 25bps Rate Cut Expected

Bill McBride discusses expectations for a 25bps rate cut by the FOMC and analyzes economic indicators affecting this decision.

your daily dose of economic commentary

Bill McBride discusses expectations for a 25bps rate cut by the FOMC and analyzes economic indicators affecting this decision.

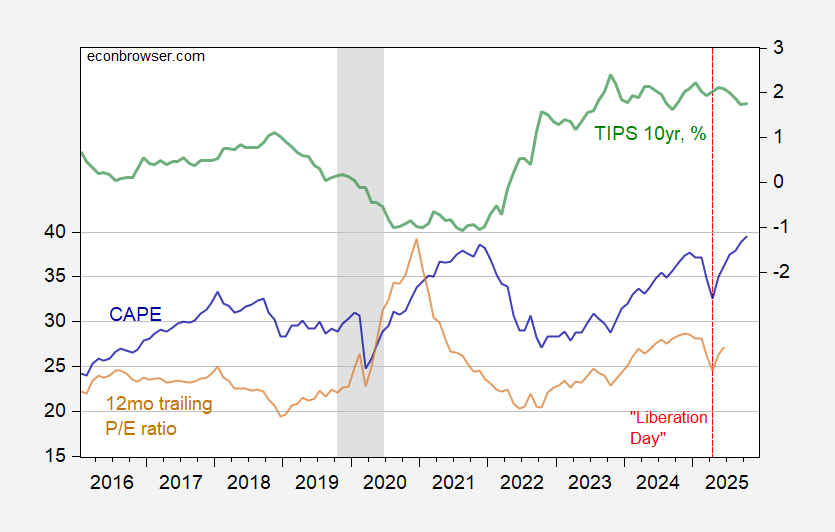

An argument that pro-growth supply-side policies may influence stock prices, particularly through financial deregulation and changing interest rates affecting valuations and risk perceptions.

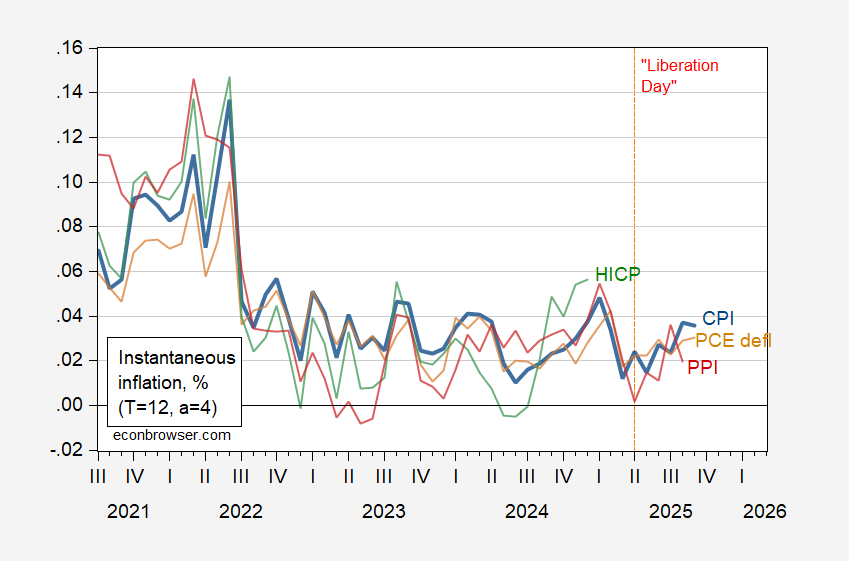

Menzie Chinn analyzes inflation data, particularly core CPI and PCE, highlighting the impact of tariffs and the implications of delayed CPI releases.

The post discusses a major NBA gambling scandal, highlighting insider information's impact on betting, and the intertwining of sports leagues with betting companies.

An argument that Trump threatens Canada with additional import taxes in response to an ad criticizing U.S. tariffs aired during a major sporting event.

The discussion centers on the effectiveness of civil resistance and protests in influencing public opinion, policy changes, and political outcomes in the U.S.

The post outlines the upcoming economic reports and events for the week, including the FOMC meeting and various housing and manufacturing indices.

Concerns about AI's circular deals revolve around potential revenue inflation and systemic risk, questioning whether these practices resemble illegal round-tripping or legitimate vendor financing.

The post highlights the achievements of grant recipients from the 11th cohort of Emergent Ventures India, showcasing diverse innovative projects across various fields.

The post analyzes September mortgage performance, highlighting low delinquency rates and normalizing foreclosure activity, indicating a resilient mortgage market despite some shifts in loan segments.

Rachel Treisman discusses Travis Kelce's collaboration with activist investors to revitalize Six Flags amid its recent challenges.

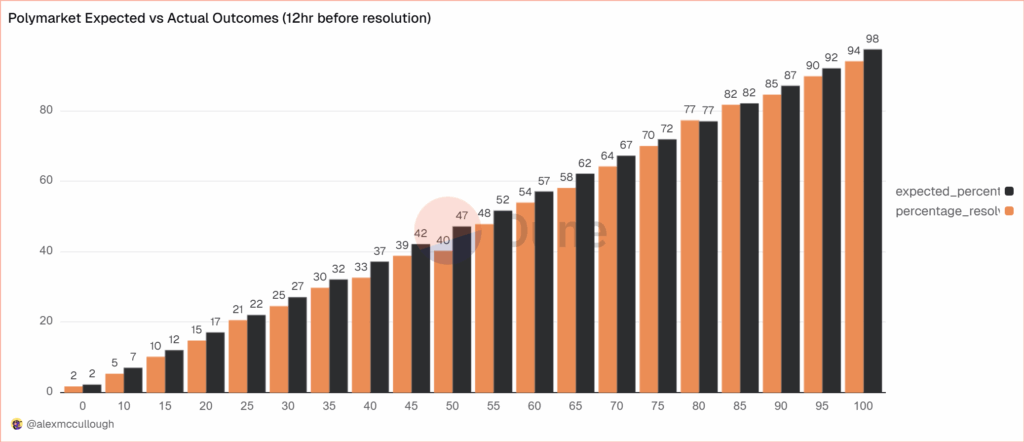

The post discusses the accuracy of prediction markets, specifically Polymarket, using Brier Scores to evaluate their predictive performance compared to other forecasting methods.

Bill McBride discusses the softening apartment market conditions in Q3, highlighting lower rent growth and improved borrowing conditions.

An argument that Trump's extravagant renovations symbolize a deeper political decay, merging personal excess with authoritarianism, undermining American democratic traditions and values.

Noah Smith discusses the rising electricity costs in America, attributing them to various factors, including the AI boom, and emphasizes the need for coherent energy policy.

Maria Aspan discusses the U.S. inflation report for September, noting it rose less than anticipated and its implications for Social Security beneficiaries.

An argument that rising non-chocolate candy sales reflect shifts in consumer preferences and challenges in chocolate production due to cocoa shortages.

Jenny Abamu discusses how approximately 1.4 million federal workers are affected by the government shutdown, receiving no pay despite many being deemed essential.

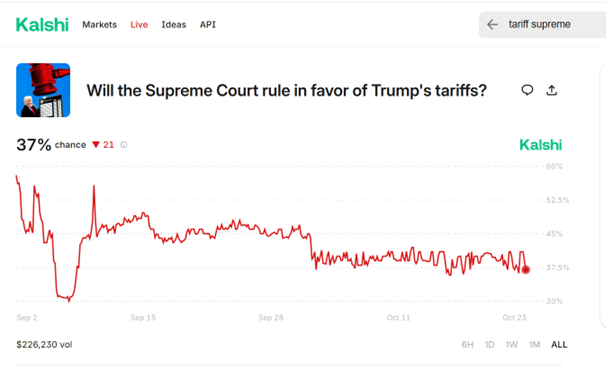

The discussion centers on the potential economic impacts of the Supreme Court's decision regarding IEEPA tariffs and their implications for tariff revenue and trade.

Nate Silver discusses the rise and fall of outsider political candidate Graham Platner, highlighting how social media revelations can impact voter perception and electability.