241. Why Europe should resist the Second China Shock

An argument that Europe faces economic challenges from a surge in Chinese high-tech exports, which could undermine local industries and trade balance.

your daily dose of economic commentary

An argument that Europe faces economic challenges from a surge in Chinese high-tech exports, which could undermine local industries and trade balance.

Robert Vienneau explores a novel economic model that combines extensive and intensive rent, focusing on production processes and their efficiencies in agriculture.

Bill McBride discusses a decrease in mortgage applications according to the MBA's latest survey, highlighting trends in refinancing and home purchases.

The discussion reflects on personal experiences of humor and emotional responses, emphasizing a steady disposition towards pleasure and displeasure rather than extreme reactions.

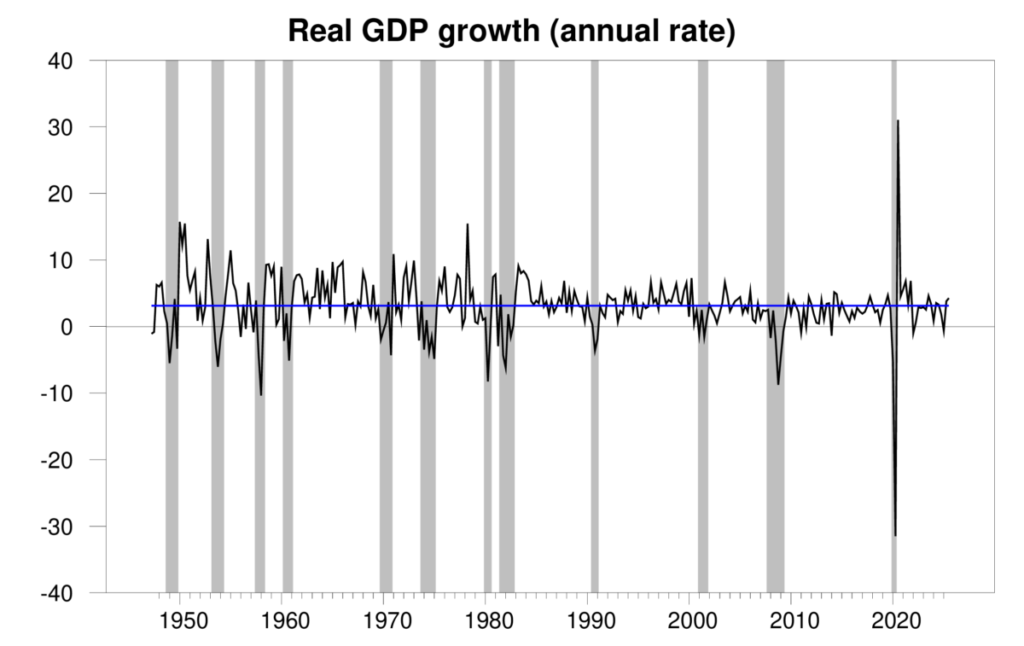

James Hamilton discusses the recent U.S. GDP growth, indicating a positive economic outlook despite some concerns in the labor market.

The author shares personal reflections on family, music, and various academic studies, intertwining thoughts on happiness and historical figures while preparing for Christmas.

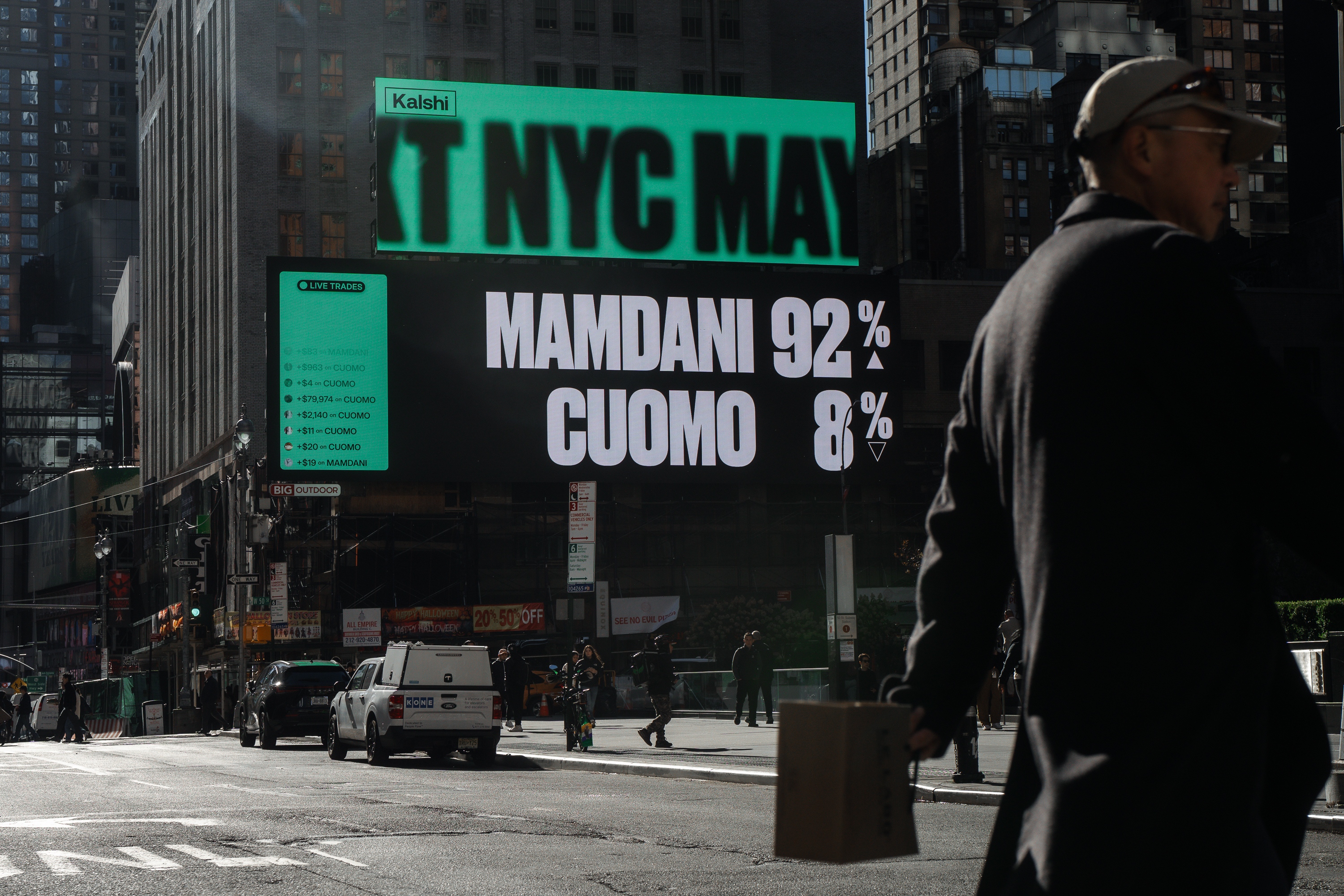

Bobby Allyn discusses the rise of election betting on prediction markets apps amid scrutiny and concerns about election interference ahead of the midterms.

Timothy Taylor discusses Japan's high government debt and explains how its consolidated debt is much lower than gross debt due to unique financial structures and low interest rates.

The post highlights holiday-related stories that illustrate economic principles, including rising prices, consumer spending, and the prevalence of holiday bonuses across different industries.

The post analyzes November's mortgage delinquency trends, attributing increases to seasonal factors and historical patterns, while noting significant shifts in prepayment and foreclosure activity.

An argument that millions of borrowers in default may soon face wage garnishment after a pandemic-related pause ends.

Alex Tabarrok discusses the transformative impact of three key figures in India's 1991 economic reforms that significantly reduced poverty and reshaped the country's economy.

Paul Krugman discusses the K-shaped economy in America, highlighting the disparity in wage growth between low-income and high-income workers during different administrations.

The post analyzes November housing market trends, noting declines in sales and prices, while forecasting potential future price declines in 2026.

Art Carden discusses the properties of silver and gold, their economic implications, and how market dynamics influence material choices in technology and decoration.

Alina Selyukh discusses the robust growth of the U.S. economy and ongoing consumer spending trends amidst political implications for voters and the Trump administration.

The post discusses recent changes in industrial production and capacity utilization, highlighting monthly increases and comparisons to historical averages.

Tyler Cowen describes Muscat, Oman as a relaxed, safe destination with rich history, cultural nuances, and a unique blend of modern and traditional elements.

Cory Turner discusses upcoming changes to federal student loan repayment options with the ending of the SAVE Plan in 2026.

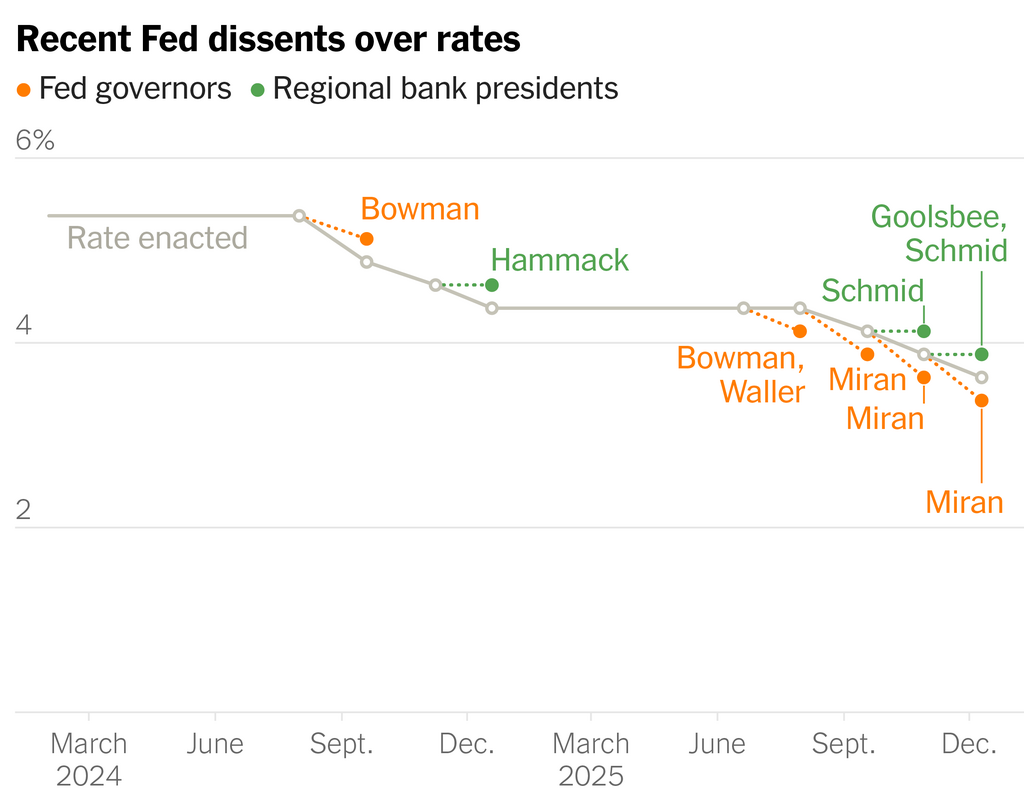

An argument that the Federal Reserve risks recession without further interest rate cuts, despite not anticipating an immediate economic downturn.