1981. Tariffs are a tax. Are you already paying it?

The discussion centers on the impact of tariffs on American consumers, highlighting how these taxes affect prices and the economy.

your daily dose of economic commentary

The discussion centers on the impact of tariffs on American consumers, highlighting how these taxes affect prices and the economy.

Deepa Shivaram discusses President Trump's comments on potentially firing Federal Reserve Chair Jerome Powell amid growing criticism from the White House.

An argument that awe can effectively engage audiences in libertarian discourse, serving as a healthier alternative to the prevalent use of anger and outrage in communication.

Timothy Taylor discusses the implications of declining fertility rates on global population dynamics, economic growth, and government finances.

Bill McBride discusses the slight increase in economic activity reported by the Fed's Beige Book, highlighting varied performance across districts and ongoing uncertainties.

Pierre Lemieux argues that "trade war" contradicts the concept of free trade, emphasizing individual motivations over political entities in economic interactions.

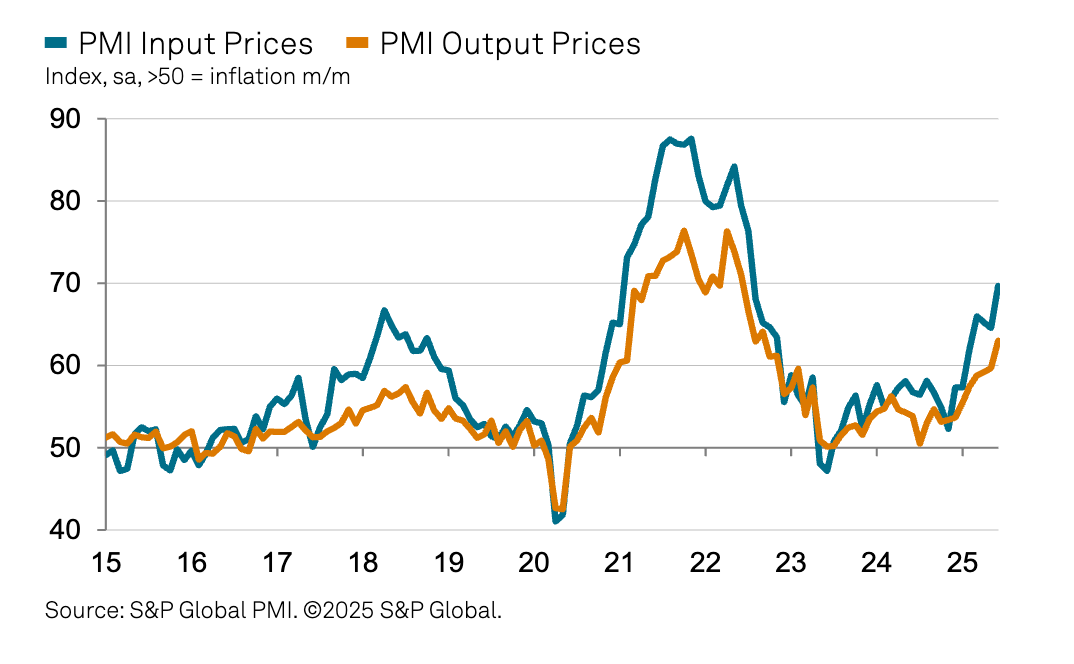

An argument that tariffs are influencing inflation and discusses the potential implications for monetary policy and the Federal Reserve's credibility under political pressure.

Bill McBride discusses the increase in industrial production and capacity utilization in June, highlighting key statistics and comparisons to previous periods.

Fluctuating tariffs and unstable financial markets are affecting the influencer industry, potentially signaling a new recession.

Noah Smith discusses how Donald Trump's shifting priorities may impact U.S. relations with China and Russia in the context of geopolitical tensions.

The post discusses Senate debates on funding cuts for public broadcasting and examines the impact of tariffs on inflation.

Bill McBride discusses a significant decrease in mortgage applications according to the latest MBA survey, highlighting trends in refinancing and purchase activity amid rising rates.

The post explores the complex relationship between Hollywood and China's film industries, highlighting their historical ties and evolving power dynamics.

Robert Smith discusses how taxes can influence behavior and potentially alleviate poverty in his blog post.

![[Rerun] Tymon Słoczyński, Econometrician, Brandeis University](https://substackcdn.com/image/fetch/$s_!zcWs!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc88e28d8-61cd-4c90-9449-6b6cf288e3e3_1792x1024.heic)

An interview with a young econometrician discusses OLS models and causal inference, highlighting the quality of his writing and insights in the field of econometrics.

Scott Sumner discusses how tariffs may lead to the implementation of a value-added tax in the U.S., potentially paving the way for a European-style welfare state.

Concerns are raised about the capacity of financial systems to manage increasing US Treasury debt, especially under stress, highlighting potential risks to market liquidity and safety.

The post discusses early projections for 2026 cost-of-living adjustments and the maximum contribution base based on current CPI-W data and wage trends.

The post highlights various stories illustrating economic principles, including tariffs, state economic growth, factory activity, and the value of college education.

An argument that discrepancies between groups do not inherently indicate discrimination, emphasizing the need for further evidence in both wage gaps and political injunctions.