501. Noahpinion's 2025 Year in Review

Key themes from the past year include the impact of tariffs on the economy, the AI boom, and misconceptions about trade and economic policy.

your daily dose of economic commentary

Key themes from the past year include the impact of tariffs on the economy, the AI boom, and misconceptions about trade and economic policy.

Timothy Taylor discusses the historical origins of Thanksgiving, including its proclamations and the economic and political implications surrounding its establishment as a national holiday.

The discussion centers on liberalism, its vulnerabilities, and connections to culture, particularly through Bob Dylan's music and its themes of freedom and self-invention.

Joshua Gans discusses the prevalence of AI-generated referee reports in academic publishing and proposes a solution for editors to assess their value.

An argument that markets can self-correct over time, suggesting caution in government interventions due to their frequent failures and inefficiencies.

The discussion centers on poverty measurement, the effectiveness of anti-poverty programs, and the complexities of poverty alleviation in the US.

An argument that poker players exhibit a mix of political views, with some leaning conservative while others hold progressive opinions, challenging assumptions about their political affiliations.

Bill McBride discusses the decline in the national mortgage delinquency rate and the rise in refinance activity due to softening mortgage rates.

Bill McBride discusses the latest Federal Reserve Beige Book report, highlighting unchanged economic activity, consumer spending trends, and labor market conditions.

The discussion focuses on recognizing and resisting common marketing tactics that create urgency and false discounts during the holiday season.

The post provides details on the upcoming Macy's Thanksgiving Day Parade, including highlights and viewing options.

Paul Krugman discusses the impact of the Fed's interest rate policy on AI-related stock prices, drawing parallels to the tech bubble of the late 1990s.

The post reflects on Thanksgiving's history, the importance of food access, and the need to reduce regulations that contribute to hunger and food waste.

The post discusses the Freddie Mac House Price Index's year-over-year increase and highlights regional declines in home prices across various states and cities.

An argument that declining educational standards and pandemic-related learning loss contribute to increasing numbers of unprepared college students, exacerbating inequality in education.

An argument that immigration policies in wealthy democracies inevitably lead to cruel enforcement measures due to rising migration demands and public opposition.

The post highlights various grant recipients from the 13th cohort of Emergent Ventures India, showcasing their innovative projects across diverse fields.

The post highlights the significant food waste in the U.S. and discusses efforts to mitigate this issue amidst rising grocery prices and environmental concerns.

The post highlights various stories related to economic principles, including job cuts, international student enrollment, and cultural trends affecting marriage interest.

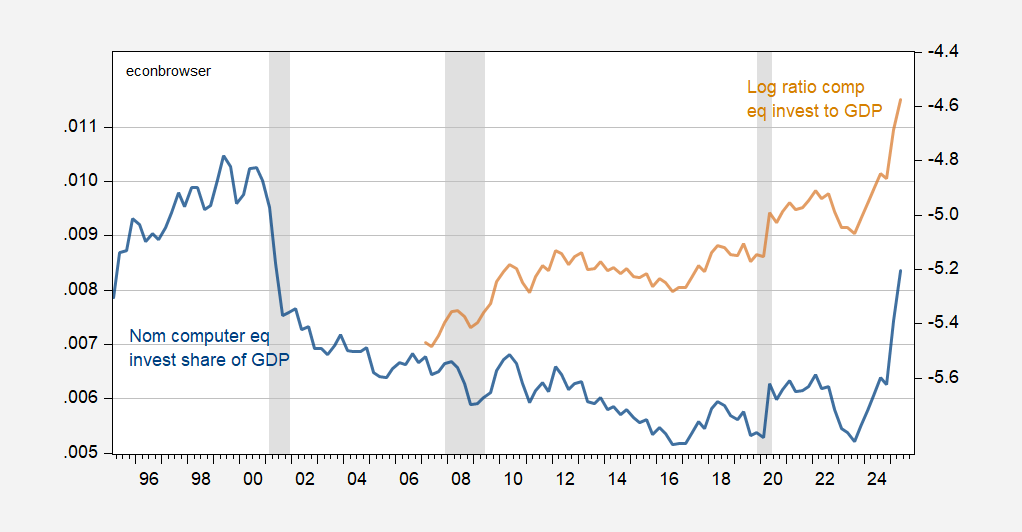

Menzie Chinn analyzes the impact of capital investment in AI on GDP growth and speculates on future trends in computer equipment investment.