3321. 4 things to know about Trump's plan for a 'crypto strategic reserve'

Juliana Kim discusses President Trump's vision for a federal strategic reserve to position the U.S. as a leader in the cryptocurrency industry.

your daily dose of economic commentary

Juliana Kim discusses President Trump's vision for a federal strategic reserve to position the U.S. as a leader in the cryptocurrency industry.

David Henderson discusses Simon Kuznets' perspective on excluding government spending from GDP, contrasting it with Greg Mankiw's criticism of the idea.

Wailin Wong discusses President Trump's executive orders and their implications for the Federal Reserve's independence and interest rate control.

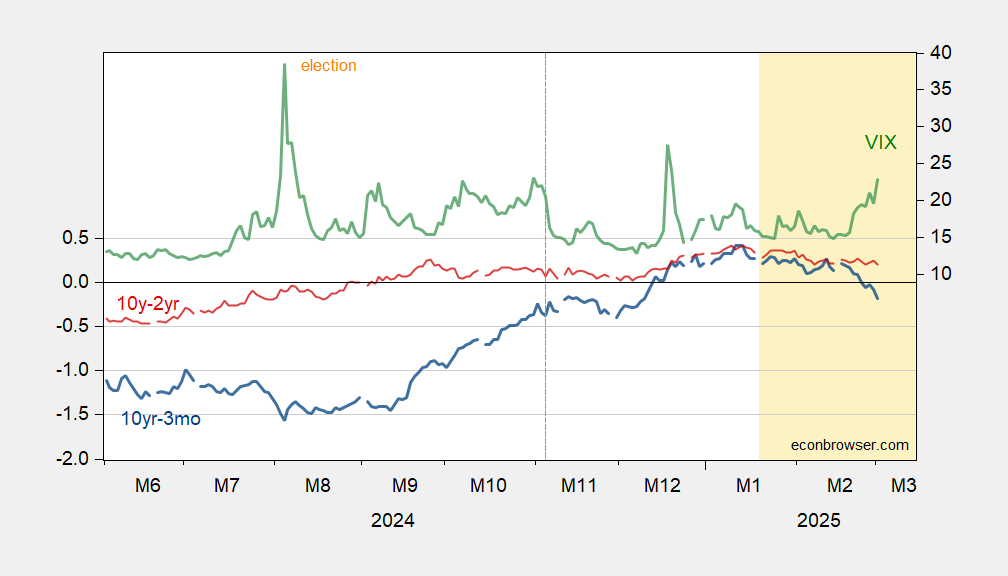

Menzie Chinn discusses the implications of current Treasury yield curves and VIX levels on economic growth forecasts.

Conversable Economist discusses the rising debt risks for low- and middle-income countries, highlighting the imbalance in capital flows and increasing debt servicing costs.

Menzie Chinn discusses the recent decline in economic nowcasts and forecasts, attributing it to trade balance changes and potential tariff impacts.

Camila Domonoske discusses how new tariffs may significantly increase car prices in the U.S. due to government policy changes.

Bill McBride discusses the increase in U.S. light vehicle sales in February, highlighting trends in affordability and market segments.

Noah Smith discusses how a proposed U.S. crypto fund could enable government leaders to distribute public funds to favored individuals, raising concerns about economic implications.

Nate Silver discusses upcoming projects, subscriber questions, and the potential resurgence of wokeness in society.

Asma Khalid discusses Trump's decision to implement 25% tariffs on imports from Canada and Mexico and its impact on markets.

Asma Khalid discusses Canada's and China's responses to Trump's tariffs, highlighting concerns about a potential global trade war and its impact on international markets.

Scott Sumner discusses housing market dynamics, investment returns, and the impact of state policies on migration patterns related to housing prices.

Scott Cunningham discusses the use of synthetic control methods in policy evaluation, particularly regarding staggered adoption and extrapolating effects to untreated units.

Alina Selyukh reports on the sudden resignation of Kroger's CEO Rodney McMullen following an investigation into personal conduct.

Alex Tabarrok discusses Stripe's insights on economic trends, AI's impact on industries, and the significance of stablecoins in enhancing financial systems.

Jadrian Wooten argues that the Economic Blackout likely harmed low-wage workers more than it affected large corporations, highlighting the disconnect between intention and outcome.

Paul Krugman discusses the historical context of European support for democracy and parallels it with the current situation in Ukraine, emphasizing Europe's responsibility to aid Ukraine against Russian aggression.

Bill McBride discusses a 0.2% decrease in construction spending in January 2025, highlighting trends in private and public construction investments.

Calculated Risk analyzes recent trends in housing inventory, noting a slight week-over-week decrease but a significant year-over-year increase.