2741. Stablecoins and Monetary Policy

An argument that stablecoins do not significantly threaten monetary policy, as the Federal Reserve retains control over the monetary base and can adjust supply and demand effectively.

your daily dose of economic commentary

An argument that stablecoins do not significantly threaten monetary policy, as the Federal Reserve retains control over the monetary base and can adjust supply and demand effectively.

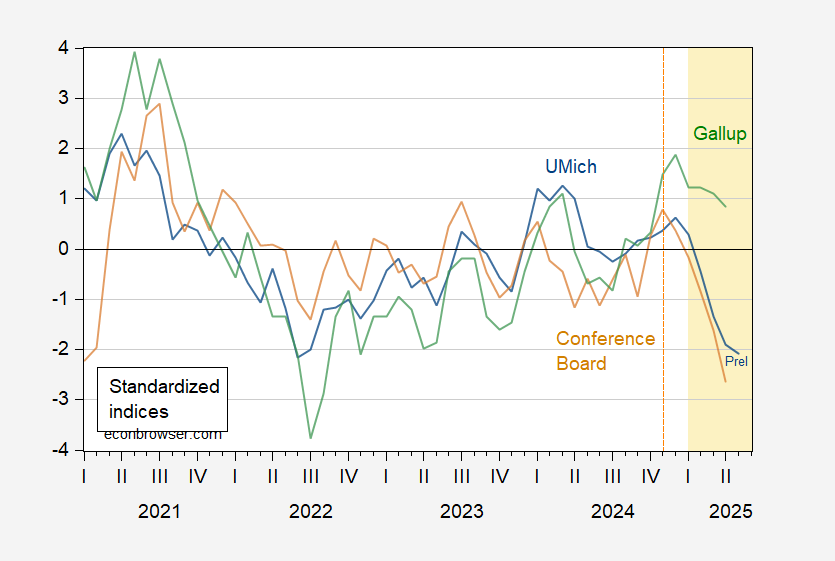

Menzie Chinn discusses declining economic sentiment and rising inflation expectations based on various confidence indices and survey data.

An argument that tariffs hinder innovation and competition, exemplified by the poorly designed Hindustan Ambassador car, illustrating the long-term negative effects of protectionist policies.

The post discusses the role of small firms in international trade, highlighting their dual function as major importers and exporters within global supply chains.

An argument that excessive adherence to rules undermines moral development and societal flourishing, advocating for discretion and understanding the purpose behind regulations.

An argument that recent tariff reductions do not signify the end of the trade war, as significant tariffs remain and will adversely affect the economy and lower-income families.

Housing starts increased in April, with multi-family units rising, while single-family starts declined year-over-year and building permits decreased from March levels.

Two Democratic board members challenge President Trump's authority to fire them, referencing federal law and Supreme Court precedent in their court case.

Maria Aspan discusses how UnitedHealth's significant stock decline is negatively impacting the Dow Jones Industrial Average.

Menzie Chinn discusses the need for new approaches in international economics, highlighting the impact of tariffs on trade dynamics.

An argument that AI training deals with Saudi Arabia and UAE could significantly impact global power dynamics, particularly regarding US-China relations and technological leadership.

The post discusses Japanese asset purchases, brain-controlled iPhones, and the financial implications of Trump tax cuts.

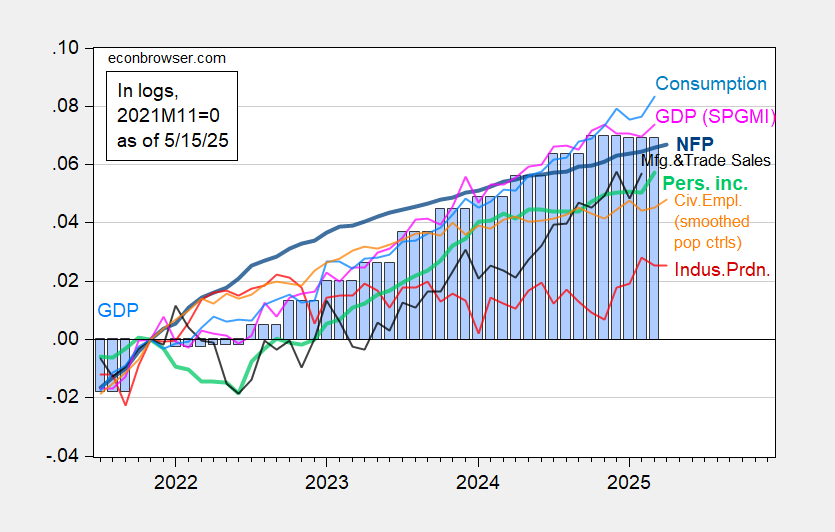

Menzie Chinn analyzes recent economic indicators, highlighting a contraction in manufacturing and industrial production as of mid-May.

An argument that government interventions in housing and immigration policies distort market signals, leading to unintended consequences and higher prices rather than effective solutions.

Nate Silver critiques media coverage of Biden's fitness for office, highlighting concerns over his age and decision-making abilities amidst significant national and global crises.

The post discusses the acquisition of Foot Locker by Dick's Sporting Goods and the challenges posed by tariffs and competition in the retail market.

Jon Murphy emphasizes the significance of trade theory in understanding economic patterns, particularly how trade affects jobs and wages in different sectors.

An argument that emphasizes the importance of preparedness for future pandemics through strategic policy measures, including improved surveillance and vaccine development.

Rachel Treisman discusses Warner Bros. Discovery's decision to revert the streaming platform Max back to its original name, HBO Max, due to branding issues.

The discussion centers on government overreach in health care decisions, particularly regarding fluoride supplements, advocating for individual autonomy and limited government intervention.