2641. A Conversation With Barry Ritholtz

A discussion on investment strategies, focusing on common mistakes and misconceptions in finance, while also touching on broader societal issues and the current political climate.

your daily dose of economic commentary

A discussion on investment strategies, focusing on common mistakes and misconceptions in finance, while also touching on broader societal issues and the current political climate.

Bill McBride discusses the key economic reports and data releases scheduled for the week of May 25, 2025, including GDP and housing market indicators.

Menzie Chinn discusses the value and impact of U.S. foreign aid, highlighting its successes and public misconceptions following its reduction under recent administrations.

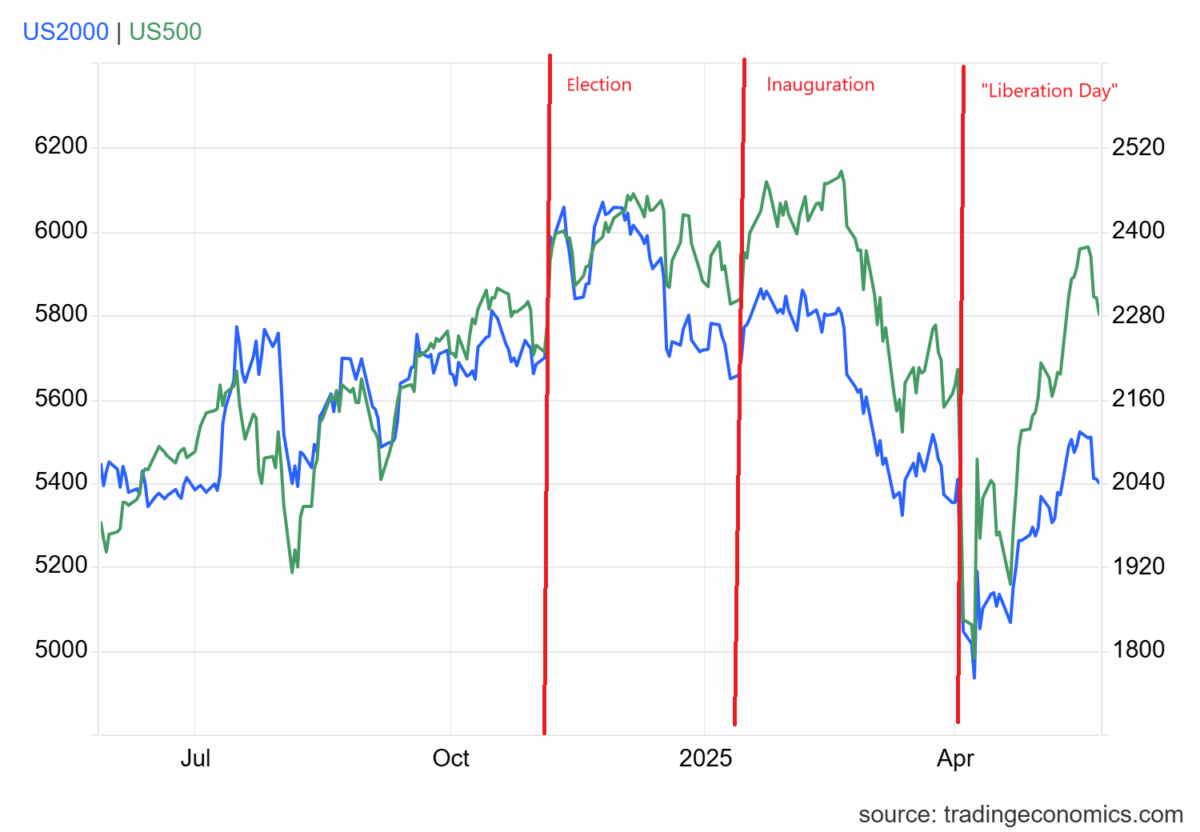

Menzie Chinn discusses the recovery of equity prices, highlighting differences between larger and smaller firm indices post-“Liberation Day.”

Tyler Cowen critiques Scott Alexander's views on US AID, emphasizing the efficiency of Emergent Ventures and advocating for a reevaluation of aid distribution practices.

Bill McBride discusses the decline in weekly COVID deaths, noting they have reached a new low and the implications for future reporting.

An argument that job availability influences migration patterns, while also considering how businesses relocate to areas with favorable conditions for labor and costs.

P.J. Vogt explores the intriguing journey of Zeke Faux as he investigates the origins and motivations behind scam text messages.

An agreement has been reached to drop criminal prosecution against Boeing regarding the 737 Max crashes, despite opposition from victims' families.

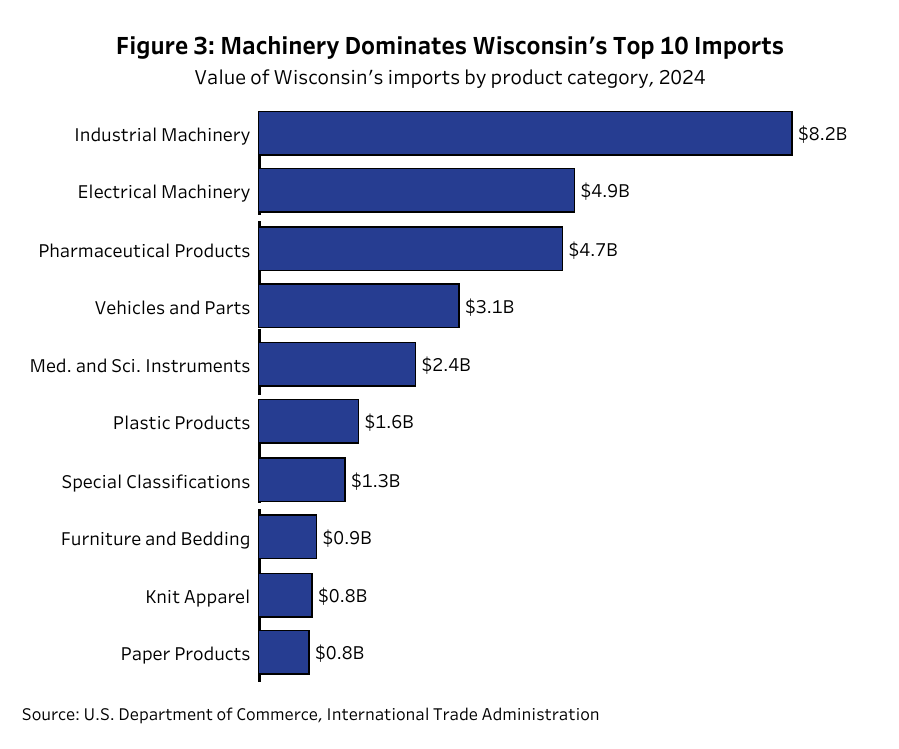

The discussion highlights Wisconsin's import and export dynamics, emphasizing the negative impact of tariffs on effective protection for exports due to reliance on imported inputs.

Michael Copley discusses the rising insurance costs in Tornado Alley, attributing the increase primarily to hail damage affecting extensive regions.

An argument that the current budget reflects poor governance, suggesting alternative fiscal policies that prioritize fairness and responsibility, particularly regarding taxation and healthcare.

New home sales rose to 743,000 in April, exceeding expectations, while previous months' sales were revised down, indicating fluctuating market conditions.

Danielle Kurtzleben discusses Trump's proposal for high tariffs on EU goods and his warning to Apple regarding iPhone manufacturing.

The post discusses rising foreclosure activity and delinquency rates in the U.S. mortgage market following the expiration of a moratorium, highlighting key statistics and trends.

An argument that commercial density and support for small businesses are essential for creating vibrant urban environments, contrasting American and Japanese zoning practices.

Andrea Hsu discusses a federal judge's ruling that restricts Trump's ability to reorganize the executive branch without Congressional approval.

Wailin Wong discusses Target's declining sales, Klarna's financial issues, and Sesame Street's new streaming platform in this week's economic roundup.

Tyler Cowen discusses two significant papers from the Journal of Political Economy that address monetary policy and income inequality trends in the U.S.

A federal appeals court's decision allows the Trump administration to proceed with plans to significantly reduce Voice of America's operations.