2041. Gold and FX Reserves in 2025Q1

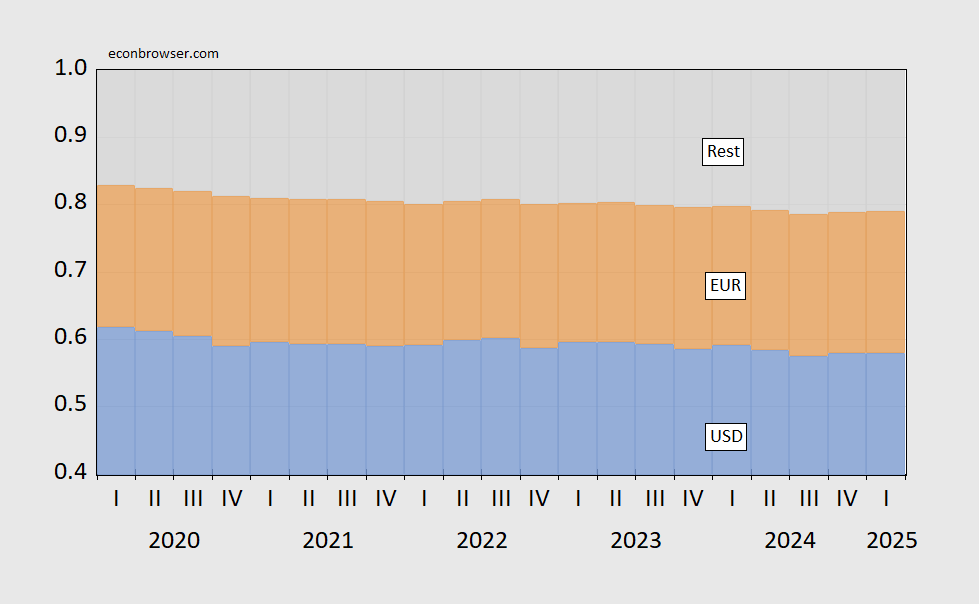

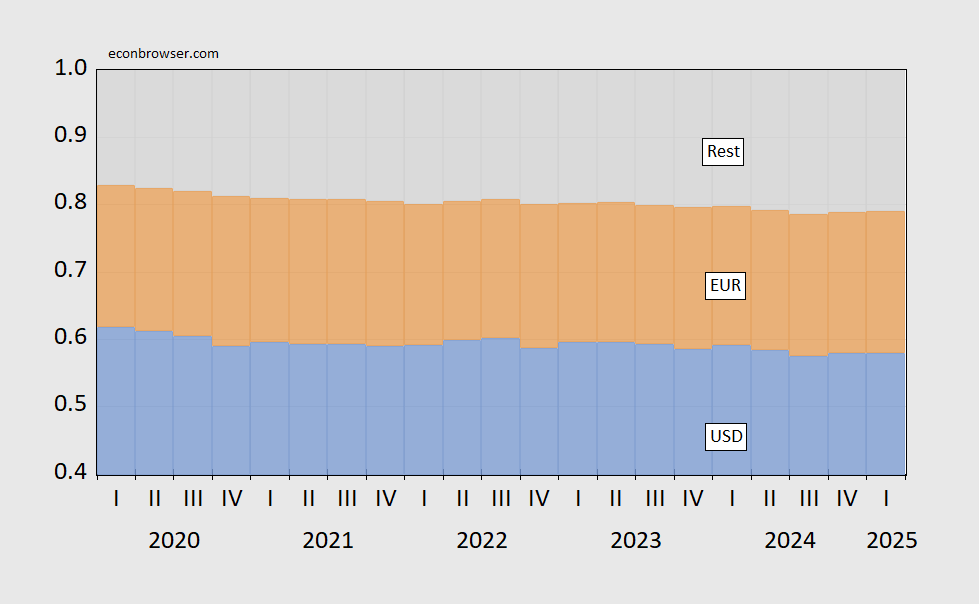

An argument that gold's significance in global reserves has increased, while the dollar's share has slightly decreased, based on IMF data and projections for 2025Q1.

your daily dose of economic commentary

An argument that gold's significance in global reserves has increased, while the dollar's share has slightly decreased, based on IMF data and projections for 2025Q1.

The discussion centers on the US dollar's reserve currency status, challenges of sovereign debt, and the overlooked social costs of debt default.

Noah Smith explores why recent tariffs haven't significantly impacted inflation, suggesting time, consumer behavior, and market dynamics as potential explanations.

Sarah Gonzalez explores the current state of domestic garment manufacturing in the U.S., including worker conditions and the industry's future prospects.

Joel Rose discusses the findings of Indian investigators regarding the fuel switches in the Air India Boeing 787 crash shortly after takeoff.

The discussion centers on how rage baiting in media drives engagement and connects to economic theories about talent concentration in entertainment industries.

The post discusses the record-high office vacancy rates and their negative impact on capital markets, particularly commercial mortgage-backed securities, highlighting ongoing challenges in the office sector.

An argument that Trump's Brazil tariff is illegal, misusing presidential power for political interference rather than legitimate economic reasons, and calls for accountability.

The post contrasts America's responses to the Sputnik launch and the DeepSeek moment, highlighting differences in ambition, investment, and national character in facing scientific competition.

An argument that a future Federal Reserve chair chosen by Trump will undermine monetary policy through loyalty rather than competence, risking economic stability.

The post discusses misleading communications from the Social Security Administration regarding the implications of a recent megabill on Social Security taxes.

The discussion centers on the implications of requiring stablecoin issuers to maintain full reserves, examining potential costs, interest rates, and regulatory impacts on the sector's stability.

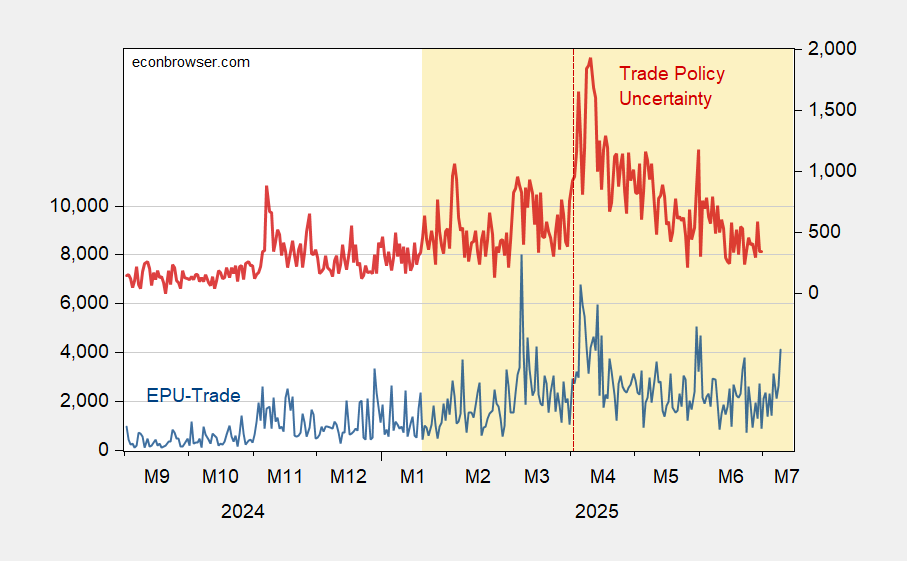

Menzie Chinn discusses trade policy uncertainty data and its implications for commodities like copper and coffee, linking it to political factors under Bolsonaro's administration.

Bill McBride discusses the increase in the Dodge Momentum Index, indicating growth in commercial real estate planning and its implications for future construction spending.

Jon Murphy discusses the importance of integrating economics with other disciplines to address complex issues, arguing against the trend of siloing knowledge.

An argument that free-market economics has been unfairly criticized, highlighting recent successes and the potential benefits of neoliberal policies, particularly in Argentina under Javier Milei.

Bobby Allyn discusses the emergence of deepfake videos on TikTok that mimic real creators' words using different voices.

An overview of the housing market in mid-July 2025, highlighting inventory increases, flat sales, and pressures on prices with regional variations.

A $3.1 billion acquisition proposal from Ferrero for Kellogg highlights significant movements in the food industry.

An argument that recent Texas flooding highlights the need for accountability in government disaster preparedness and critiques the long-standing anti-government sentiment in U.S. politics.